Wearables have the potential to transform healthcare through the ability to remotely measure and analyze patient data in real-time

In 2018, the wearable tech market was worth approximately $23bn and is likely to grow to $54bn by 2023, witnessing a compound annual growth rate (CAGR) of 19%, according to GlobalData, a leading data and analytics company

Wearables have been adopted in a wide range of fields; however, they have their greatest potential in healthcare to address spiraling healthcare costs, aging populations, and the burden of chronic disease.

The company’s latest report, ‘Wearable Technology in Healthcare – Thematic Research’, found that investment in wearable technology has become an increasing priority for healthcare organizations and networks, with technology incumbents becoming ever more ingrained within the healthcare value chain.

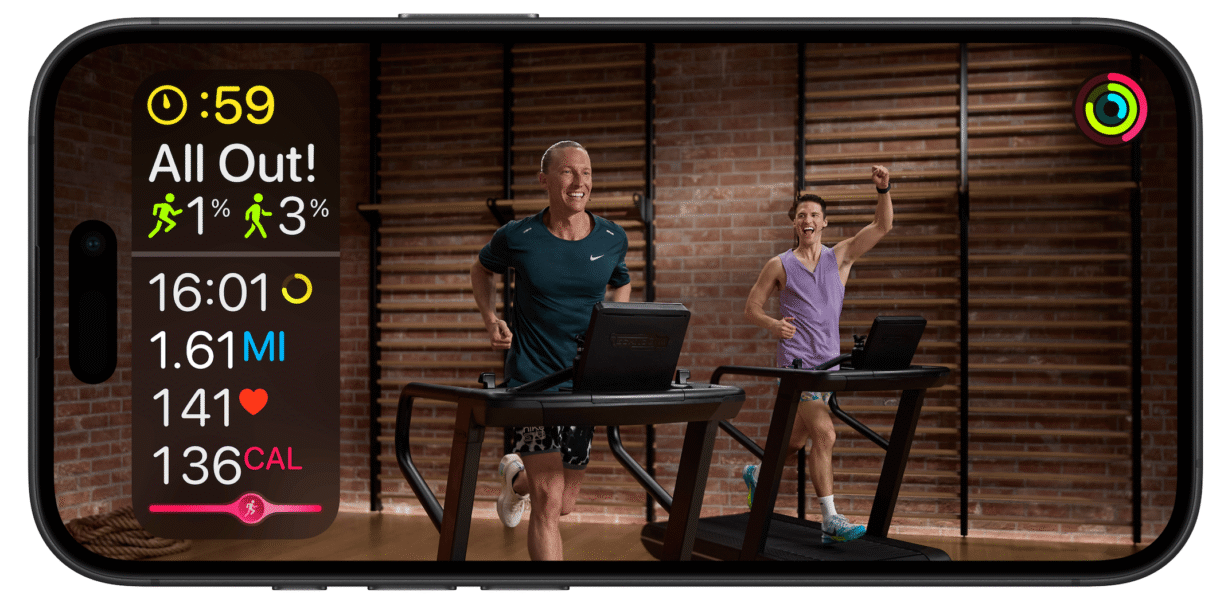

Smartwatches in 2018 accounted for nearly 60% of the overall wearables market, according to GlobalData figures. Technological improvements such as seamless body integration, health and fitness information accessibility, and modular aesthetics are key growth stimulants for smartwatches’ adoption.

With improving adoption rates in the mature markets, GlobalData estimates over 10% of the adult population in the US will adopt smartwatches in 2019.

While it is known that the smartphone component ecosystem played a critical role in getting the first wearables to market, the next wave of innovation is being driven by purpose-built silicon. Not only is Apple building unique processors and sensors into the Apple Watch, but the company is also using its own chips for the implementation of Bluetooth in AirPod wireless headphones. Samsung is using its own Exnyos SoC for the Galaxy Watch, and Huawei has two custom chips in the Watch GT.

In Q4 2018, Fitbit derived 79% of its revenue from the sales of its smartwatches, while its fitness trackers segment contributed nominally. For the full year, 44% of Fitbit’s revenue came from smartwatches, which is up from 8% in 2017. The shrinking popularity of fitness trackers in matured markets can be attributed to the rapid replication of their unique selling propositions (USPs) in smartwatches.

Eyewear is getting smarter, all thanks to augmented reality (AR) and virtual reality (VR). Despite the initial failure of Google Glass in commercial markets, it has maintained its position in healthcare and is a common feature in many teaching hospitals as a surgical training and assistance tool.

Ear-worn devices are one of the first wearable technologies developed to enhance hearing. The dramatic surge in interest for combining hearing aids with entertainment attributes resulted in the inception of smart ear-wear, or ‘hearables’, over the past three to four years.

While the market remains in the early adoption phase, hearables offer infinite possibilities in the areas of healthcare and fitness. From heart rate measurements to sleep monitoring, steps and calories tracking, and brain waves analysis, hearables perform a variety of functions. The integration of Amazon’s Alexa, Apple’s Siri, Google Assistant, and IBM’s Watson is making hearables smarter.

Skin patches, formerly simple devices have evolved to facilitate more complex functions while being thin and flexible from being manufactured using nanomaterials, flexible electronic technologies, and sensors. Consequently, the definition of “skin adhesive patches” is broadening to include smart technologies allowing connectivity with Internet of Things (IoT) devices.

GlobalData expects that miniaturisation and lowered costs of development will create a surge for wearable sensors in healthcare, causing considerable market growth. Currently, leaders in the space include small companies like iRhythm, based in San Francisco, which has launched its Zio single-use patch to monitor heart rhythms for up to 14 days remotely.